Balancing Books and Words: How Literature Shapes Financial Thinking:

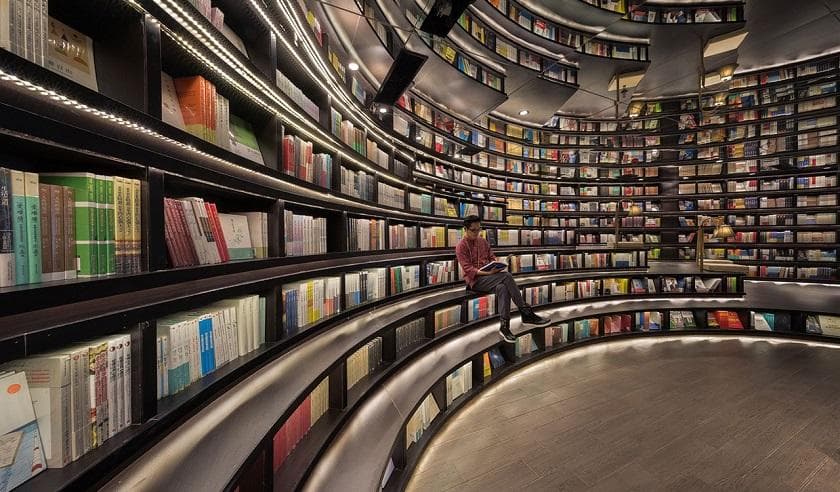

There are many ways to expand your knowledge of finance and accounting. However, one of the most fascinating and little-studied methods is reading good literature. Books, whether classic fiction, mysteries, or nonfiction, can shape your financial thinking and provide unique lessons about money, investing, and resource management.

The art of describing finances

Literary works enrich our vocabulary and ability to describe financial processes. Authors often use metaphors and analogies in their books to explain complex concepts. For example, Jordan Belfort, author of The Wolf of Wall Street, uses colorful illustrations to explain stock market trading principles. Such images make the material more accessible and interesting.

Social dynamics and resource management

Many novels and works of literature also explore social dynamics and resource management. Great novels, such as Jane Austen’s Pride and Prejudice or Leo Tolstoy’s War and Peace, examine the financial aspects of characters’ lives, showing how social status and wealth influence their decisions and relationships.

Ethics and Finance

The literature also raises important questions about financial ethics. Morgan Housel’s The Unusually Honest Banker explores the dilemmas faced by professionals in the world of finance and accounting. These works help readers think about what it means to be honest and responsible in the world of money.

Personal financial education

In addition to cultural and intellectual enrichment, literature can be useful for personal financial education. Books on investing, taxes, and debt management can help readers better understand how to manage their finances.

Literature has the unique ability to combine cultural heritage with practical lessons about finance and accounting. Reading books allows you to balance books and words, expanding your horizons and shaping your financial thinking. As you pick up your next book, remember that behind every page there may be a valuable lesson about the world of money.

Personal stories of success and failure

Literature also gives us access to personal stories of successful and unsuccessful people in the field of finance. Autobiographies of entrepreneurs and investors, such as Ashley Vance’s Elon Musk: Tesla, SpaceX, and the Quest for a Visionary Future, or Jason Kelly’s Mayhem, chronicle the paths to success, overcoming challenges, and the lessons they learned from their experiences. These books inspire and provide an opportunity to learn from other people’s mistakes and successes.

Risk/Reward Ratio

As an important aspect of finance, the risk-reward relationship is also reflected in the literature. Novels and dramas, where characters face a choice between stability and the chance for greater profits, allow readers to think about the complexities of investing and financial planning.

Inspiration and creativity

Literature can contribute to your financial thinking, not only by providing information, but also by inspiring new ideas and creative approaches. Great writers often address the human desire for success and prosperity, and their works can encourage you to find innovative solutions to financial matters.

Variety of genres and approaches

Literature in the field of finance and accounting offers a variety of genres and approaches, allowing everyone to find books that suit their preferences and level of knowledge. From economic thrillers to how-to guides to investing, literature provides a vast field of study and learning.

Understanding behavior and motivation

Many literary works analyze human behavior in the context of financial decisions. This can be especially useful for accountants and financial analysts who work with people and companies. Reading such books helps you understand how motivation and psychology influence financial decisions.

Formation of critical thinking

Literature presents the reader with various moral dilemmas and ethical questions. By looking at stories related to money, you can develop critical thinking and the ability to analyze complex situations. These are skills that are extremely important in the world of finance.

Inspiration for career growth

Literature can also serve as inspiration for a career in finance. Many biographies of successful financiers and entrepreneurs, such as Walter Isaacson’s Steve Jobs: A Biography or Roger Lowenstein’s Warren Buffett: Business, Life and Philosophy, tell the story of the paths to success and overcoming difficulties. These stories can inspire you to achieve your own.

Trusting your accountant or financial professional is important for several important reasons:

- Compliance and Tax Security: A professional accountant ensures that your financial transactions comply with laws and tax requirements. He knows the current tax regulations and helps minimize tax liabilities while remaining compliant with all regulations.

- Accuracy and Reliability: Accountants have the skills and knowledge necessary to maintain high accuracy in accounting and financial reporting. This is important both for your organization and for your investors, creditors and tax authorities.

- Time saving: Setting up and maintaining accounting is a labor-intensive process. A professional can ensure that your time is used efficiently, allowing you to focus on the key aspects of your business.

- Financial Management: An accountant doesn’t just record transactions, but also analyzes financial information, giving you insight into the state of your finances. This helps in making informed decisions and planning.

- Preventing Errors and Fraud: A professional accountant can identify potential errors and fraud, helping to protect your organization financially.

- Long-term sustainability: Proper accounting and financial planning help ensure the long-term sustainability of your business. An accountant can help you develop strategies to achieve your goals.

- Professional Responsibility: Professional accountants are subject to the codes of ethics and regulations of their industry, which means they are responsible for their work. This gives you additional confidence in the safety and integrity of your finances.

- Compliance with investor and creditor requirements: If you have investors or creditors, they will often require the involvement of a professional accountant to ensure transparency and reliability of financial reporting.

Ultimately, trusting an accounting professional is an important aspect of successful financial management in an organization. You can find good advice and professionals on the website www.realtaxusa.com. This helps avoid legal and financial problems, ensures the accuracy and reliability of data, and facilitates financial management, which is important for both businesses and individuals.

Conclusion:

Literature and financial thinking are an unusual combination that can bring many benefits. Books shape our financial thinking, expand our horizons and inspire success. Whether you’re a financial professional or a beginner, literature provides invaluable lessons and ideas that can change the way you think about money and financial decisions. Don’t miss the opportunity to tap into this source of knowledge and inspiration on your path to financial literacy and success.